The changes of the last three years have many of us reassessing our financial needs and what it really looks like to be happy, and live well. According to the co-founder of Stackin, Tom Brammar, many long-held beliefs, patterns from our upbringing, and social fears keep many of us from managing our money in a way that could bring us more joy.

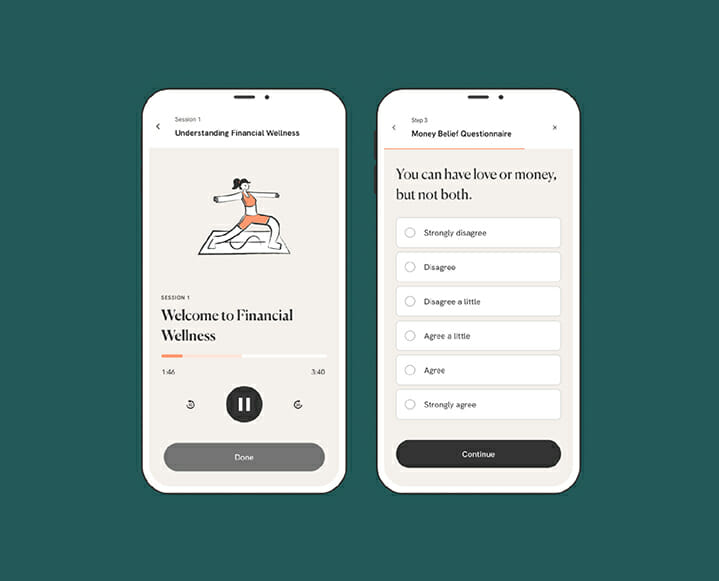

The beliefs-driven language Tom uses in our interview below is a tell to how his app, Stackin really works. Yes, you’ll receive a personalized plan from the Stackin team, set goals and focus on growth, but not before taking time to understand where your hang-ups with finance management really are.

Re-Evaluate Your Anxiety About Money

with Stackin's Tom Brammar

Brammar unpacks the most common hang-ups that hold many of us back from financial wellness. If you make just a handful of resolutions this year, consider facing your fears around money and taking your financial health to another level.

With the Stackin app, you’ll learn how your money impacts your emotions, so you can prioritize the things that bring you the most joy!

What do you think holds most people back from managing their finances in a way that works?

We've found that there are four core reasons people shy away from managing their money well:

Lack of financial education. We’re never really taught how to manage our money. We’re told to budget, and to make sure we’re saving enough, but there is very little effort put in to teach people how to do those things.

Early beliefs about money. We have a relationship with money that is shaped early in our lives, but very rarely examine it. That relationship is built on a series of beliefs about money, which influences our behavior. When we don’t take the time to truly inspect our own mindsets about money, it is difficult to change our behavior.

Lack of personalized planning. The idea of there being one way to manage our finances is a fallacy. We are all different, and what works for one person might not work for someone else. We still talk about being ‘good’ or ‘bad’ with money as if there is a single approach! We need to change what ‘good’ looks like, and how we talk about money with each other.

Lack of goal-setting is a frequent block for many of our users. It’s helpful to develop a defined idea of what you actually want from your money. Personalized priorities help you to define a more meaningful sense of happiness than the dopamine hit we get from shopping without a plan.

Many people get nervous about juggling numbers – especially when they are attached to dollar signs! How does Stackin help those who are anxious about managing their money?

Trying to figure out how to manage your money by staring at those numbers with dollar signs is like trying to lose weight by staring at the dial on your weight scale.

We think there’s plenty of evidence to show that this fixation doesn’t work and so we’re pioneering a different approach.

First, we need to recognize that our behavior with money is governed almost exclusively by our relationship with it. This in turn is the result of our beliefs around what money is and how we should interact with it.

Do you exhibit “money protection” or "money romance" behavior?

Research suggests that these beliefs are formed very early in our lives – between the ages of 6-10 years old — and then are embedded deep in our limbic system. Our beliefs are so powerful that they control our behavior in ways that are outside of our everyday consciousness. No matter how hard we try and act in a logical manner, if that logic goes against long-held beliefs and our natural limbic response, our limbic response always wins.

If you grew up in a family with a history of money worries, it’s likely that you’ll exhibit behavior that we title “money protection”; if you experienced a negative change in your family’s financial circumstances early in your life, you’re more likely to exhibit "money romance" behavior. At Stackin, we help to diagnose these behaviors and then create a personalized pathway to manage and harness these limbic reactions so we can take back control and start to use our money in ways that make us happy and fulfilled.

So many feel that because they don’t have “enough” money, they cannot manage their finances in an organized way. You must have a lot to say about that! Tell us what these finance-averse folks should know.

One of the most powerful things we ask an individual to do after they’ve first signed up on Stackin is to categorize their most recent discretionary transactions by how these purchases made them feel and not by its amount or merchant.

Now they’re confronting whether or not all those Amazon purchases actually brought them real joy.

Through this we find that many people who feel like they’re living paycheck to paycheck are actually spending a large amount of the money they have control over on things that don’t make them happy.

Our next step is then to encourage them to change this behavior – not reduce their spending, but adjust it to focus on things that make them happier. We find that these individuals realize they actually do have control over their money and can alter their spending patterns to free up cash to put towards their longer-term goals.

3 Myths About Money Management To Overcome

01 The solution to money anxiety is simply to earn more money.

Not true. Nearly a half of all Americans who earn more than $100k and nearly a third earning over $250k admit to feeling they’re living paycheck to paycheck.

02 The solution to money anxiety is simply to “Make a budget!” or “Track your spending better!”

Although well meaning, this advice never helps fix the problem. In fact, it can actually make the situation worse when a person perceives they’ve failed at what seems like such a simple task because it creates more negative emotions, further increasing despondency and a lack of general confidence.

03 The idea that some people are just “bad with money” because they are too emotional.

We disagree strongly. Our emotions motivate and inspire us. You are not “bad at money”, you just haven’t been set up for success. Tapping into what motivates us is how we change our relationship with money and achieve our goals.

Can you tell us as recent story from a user that thrilled the Stackin team?

The smallest wins tend to be the ones we celebrate the most because they often happen at the start of our users’ journeys.

One of our users recently broke up with her boyfriend and instead of panicking and splurging on Doordash (which typically makes her feel guilt and shame), she stopped herself and instead was able to use that $100 for new furniture as she gets her own place. That might not seem like a big change — she’s still spending the same amount of money — but she’s no longer using money to emotionally cope, and is instead prioritizing what makes her truly happy.

Stackin helps users to approach their finances as a wellness issue. Talk to us about that.

In the early stages of our product research, we performed over 250 hours of user interviews with Americans across the country. What we found was these individuals clearly understood what they had to do to improve their financial health and how to do it but couldn’t understand why they weren’t able to do it.

They had grand ambitions: buying a house, retiring early, taking the kind of vacation that Instagram is algorithmically designed to promote to make the rest of us feel jealous. But they consistently failed to make those goals happen. This in turn affected their confidence, their view of their own self-worth, drove up feelings of anxiety and despair, and in turn fed back into their general inability to take the actions required to improve their financial health.

It was at this point that a light bulb went off: we were thinking about this the wrong way around. This wasn’t a finance problem.

This was a health problem.

We love that approach. There is a surprising amount of peace that comes from seeing how your money moves and not hiding from your budget. How does Stackin get people started there?

We love that approach. There is a surprising amount of peace that comes from seeing how your money moves and not hiding from your budget. How does Stackin get people started there?

When you feel good about your money, then seeing where it is going can feel exciting and empowering. If you don’t feel good about your money, budgets can feel overwhelming and depressing.

What we do is help people build sustainable financial behaviors so that they can achieve their goals. We help our users to understand their relationship with money, and we help them build the behaviors that give them confidence when it comes to their money.

Tell us how the service works. Can users employ Stackin’s tech to manage their everyday budgets?

When we talk about budgets, we mean two things:

+ What is the life (and lifestyle) we want to lead?

+ What are the behaviors that support us getting there?

Using Stackin, users are coached to help them identify what it is they want to use their money for, and to build sustainable behaviors that make those possible. Together, we help our users identify behaviors they want to change, or new ones they want to start.

The simplest example of this is spending. We all have spending behaviors that we don’t love and want to change. Using Stackin we can help users identify what that behavior is, and then start to shift that behavior to free up money and use it in a way that matches what they want.

Stackin also helps users prepare and deal with crisis. Can you explain how that works?

Managing money is a mix of skillset and mindset. The skillset is familiar to most of us: try to spend less than you make, build up an emergency fund, and so on. Your mindset isn’t talked about as much. That’s where we start: we can only control ourselves, not the world around us.

Stackin helps users to first understand themselves, what they believe and how they behave. That awareness is crucial to being resilient and staying calm. Pairing that mindset with the behaviors that our users build up helps them to stay afloat no matter what crisis they are confronting.

Start by finding out what your dominant money belief is with our free Stackin assesment designed to do just that. Once you learn more about this, download the app and get started!

Take the Stackin Assessment:

Get clarity. Feel good. Be confident. Complete Stackin’s free assessment to assess your current “relationship” with money. Then, follow along with Stackin’s custom insights and personal coaching to grow your confidence around your goals, spending, and long-term planning.

This story is brought to you in partnership with Stackin. From time to time, TCM editors choose to partner with brands we believe in to bring our readers special offers. All material on The Chalkboard Mag is provided for educational purposes only.

The post 6 Tips From The Financial App Founder Who Wants To Reduce Your Anxiety About Money For Good appeared first on The Chalkboard.

from The Chalkboard https://ift.tt/XWlc1Ej

via IFTTT

No comments:

Post a Comment